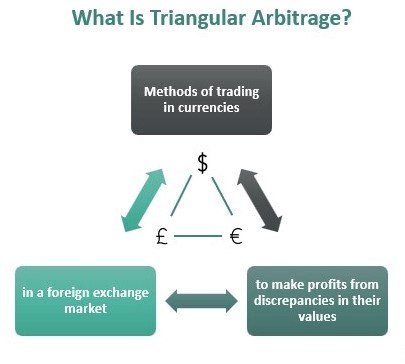

Triangular arbitrage is a forex trading strategy that capitalizes on price discrepancies among three different currency pairs involving a common currency. By exploiting these inefficiencies, traders can generate risk-free profits through a series of rapid currency exchanges. Triangular arbitrage is a complex and time-sensitive strategy often executed by high-frequency trading (HFT) firms due to its short-lived opportunities. Let’s explore triangular arbitrage with an example:

Example of Triangular Arbitrage:

Consider the following currency exchange rates:

- USD/EUR: 1.1000 (1 US Dollar = 1.1000 Euros)

- EUR/GBP: 0.9000 (1 Euro = 0.9000 British Pounds)

- USD/GBP: 0.9900 (1 US Dollar = 0.9900 British Pounds)

In this example, we notice a potential triangular arbitrage opportunity. Let’s assume we have $1,000, and we intend to execute triangular arbitrage between these three currency pairs.

Step 1: Exchange USD to EUR

With $1,000, we can exchange it for Euros at the rate of 1 USD = 1.1000 EUR. Therefore, we receive:

$1,000 * 1.1000 = 1,100 EUR

Step 2: Exchange EUR to GBP

Next, we convert the 1,100 Euros to British Pounds at the rate of 1 EUR = 0.9000 GBP. Therefore, we receive:

1,100 EUR * 0.9000 = 990 GBP

Step 3: Exchange GBP to USD

Finally, we convert the 990 British Pounds back to US Dollars at the rate of 1 USD = 0.9900 GBP. Therefore, we receive:

990 GBP * 0.9900 = 980.10 USD

Result:

Starting with $1,000, we have ended up with $980.10 after executing the triangular arbitrage strategy. However, this example assumes that there are no transaction costs, slippage, or market delays. In real-world scenarios, these factors can impact the profitability of the strategy.

Explanation:

If the triangular arbitrage opportunity was efficient and free from transaction costs, the starting and ending value in US Dollars would have been the same. However, the difference between the initial and final amounts, in this case, $19.90 ($1,000 – $980.10), represents the potential profit from triangular arbitrage.

Notes:

- Triangular arbitrage opportunities are short-lived and arise due to discrepancies in currency exchange rates among various markets and liquidity providers.

- The forex market is highly competitive, and any detected arbitrage opportunities are quickly exploited, leading to market corrections and nullifying the opportunities.

- High-frequency trading (HFT) firms are better suited to execute triangular arbitrage due to their low-latency access to market data and rapid execution capabilities.

Conclusion

Triangular arbitrage is a complex forex trading strategy that exploits currency exchange rate inefficiencies to generate risk-free profits. It involves a sequence of rapid currency exchanges based on discrepancies among three currency pairs involving a common currency. However, triangular arbitrage opportunities are short-lived, and execution requires advanced technology and speed. Traders should be aware of transaction costs, slippage, and market conditions to successfully implement this strategy. Triangular arbitrage plays a significant role in maintaining currency exchange rate equilibrium and promoting market efficiency in the forex market.