Trendlines and channels are essential tools in technical analysis used to identify and visualize trends and potential trading opportunities in financial markets. They help traders understand the direction of price movements and provide valuable information about the strength of a trend. Here’s an explanation of trendlines and channels:

Trendlines

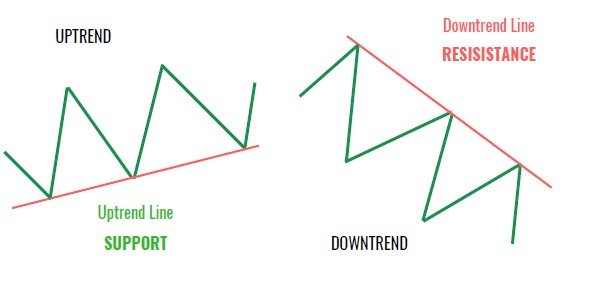

- Trendlines are straight lines drawn on a price chart to connect a series of higher lows (in an uptrend) or lower highs (in a downtrend).

- In an uptrend, a trendline is drawn below the price, connecting the higher swing lows. It acts as a support line, indicating where buying pressure is entering the market.

- In a downtrend, a trendline is drawn above the price, connecting the lower swing highs. It acts as a resistance line, showing where selling pressure is entering the market.

- A trendline can help traders visually identify the general direction of the trend and anticipate potential trend reversals when the trendline is broken.

Channels

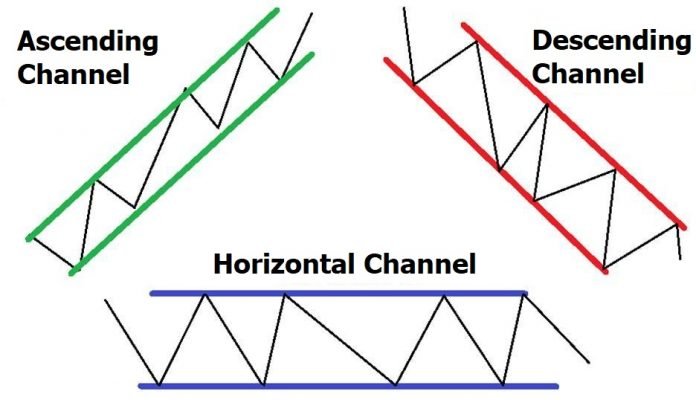

- Channels are formed by drawing two parallel trendlines on a price chart to contain the price movement within a defined range.

- In an uptrend, an ascending channel is formed by drawing a lower trendline connecting higher swing lows and an upper trendline connecting higher swing highs.

- In a downtrend, a descending channel is formed by drawing an upper trendline connecting lower swing highs and a lower trendline connecting lower swing lows.

- Channels provide traders with a clearer picture of the trend’s trajectory and help identify potential support and resistance levels.

Traders use trendlines and channels to make informed trading decisions, including:

- Trend Identification: Trendlines help identify the prevailing trend in the market, allowing traders to align their trades with the overall direction of price movements.

- Entry and Exit Points: Traders may use trendline breaks or bounces from trendlines as signals to enter or exit positions.

- Stop Loss Placement: Trendlines can also serve as guides for placing stop-loss orders to manage risk in case the trend reverses.

- Channel Trading: Traders may consider buying near the lower trendline in an uptrend and selling near the upper trendline in a downtrend, aiming to profit from price movements within the channel.

It’s important to note that while trendlines and channels are valuable tools, they are not foolproof indicators. Traders should combine them with other technical analysis tools and consider fundamental factors to make well-informed trading decisions. Additionally, trendlines and channels should be drawn objectively and based on significant swing points in the price chart for more accurate analysis.