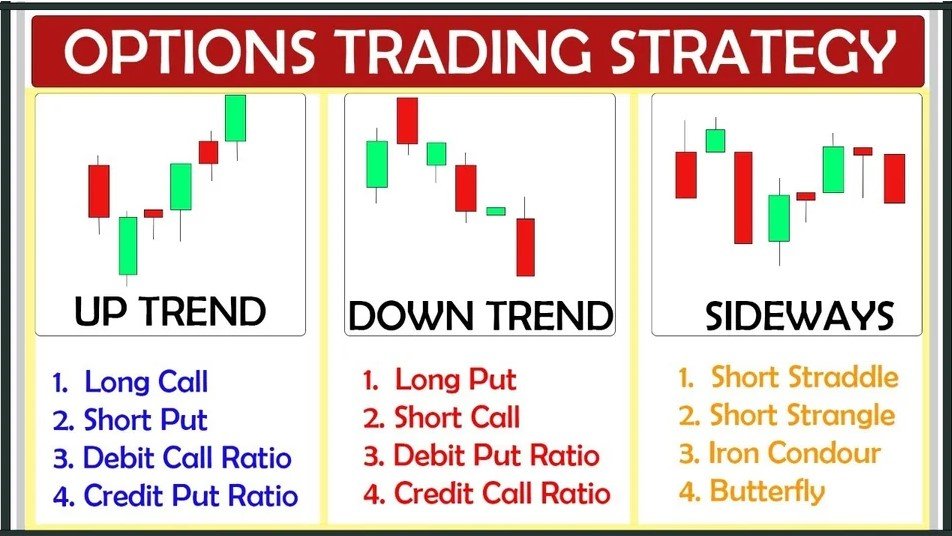

Options trading offers a plethora of strategies that allow investors and traders to tailor their positions to different market conditions and risk tolerances. These strategies involve the combination of various options contracts, enabling market participants to profit from price movements, hedge against potential losses, or generate income. In this comprehensive guide, we will explore some popular options strategies and their key characteristics.

1. Long Call:

The long call strategy involves purchasing a call option on an underlying asset. This strategy is employed when an investor anticipates the price of the underlying asset to rise significantly. By holding a long call, the trader has the right to buy the asset at the strike price before the expiration date. If the asset’s price exceeds the strike price plus the premium paid, the trader will profit.

- Risk: Limited to the premium paid for the call option.

- Reward: Unlimited, as the underlying asset’s price can increase significantly.

2. Long Put:

Conversely, the long put strategy entails buying a put option on an underlying asset. This approach is adopted when an investor expects the asset’s price to decline substantially. Owning a long put allows the trader to sell the asset at the strike price before the expiration date, thus benefiting from a decline in the asset’s value.

- Risk: Limited to the premium paid for the put option.

- Reward: Potentially significant, as the underlying asset’s price can decrease significantly.

3. Covered Call:

The covered call strategy combines stock ownership with selling (writing) call options. Investors employ this strategy to generate income from the premiums earned while holding a long position in the underlying asset. By selling call options against the owned shares, the trader receives a cash premium, which can offset potential losses if the stock’s price decreases.

- Risk: Limited, as the covered call strategy provides partial downside protection due to the premium received from selling the call option.

- Reward: Limited, as the trader’s potential upside is capped by the obligation to sell the stock at the strike price if the call option is exercised.

4. Protective Put:

The protective put strategy, also known as a married put, involves buying a put option to protect an existing long position in the underlying asset. Traders use this strategy to hedge against potential losses in the asset’s value. If the asset’s price falls, the put option’s value will increase, offsetting some of the losses on the underlying asset.

- Risk: Limited to the premium paid for the put option.

- Reward: Potentially significant, as the put option can offset losses on the underlying asset if its price declines.

5. Straddle:

A straddle strategy involves simultaneously buying a call option and a put option on the same underlying asset, with the same strike price and expiration date. This strategy is suitable when the trader expects significant price volatility but is unsure of the direction the asset will move.

- Risk: Limited to the combined premiums paid for both the call and put options.

- Reward: Potentially significant, as the trader profits if the underlying asset’s price moves significantly in either direction.

6. Iron Condor:

The iron condor strategy combines both bullish and bearish positions by simultaneously selling an out-of-the-money call spread and an out-of-the-money put spread. The objective is to benefit from low volatility and a range-bound market. Traders use this strategy when they expect the underlying asset’s price to remain relatively stable.

- Risk: Limited, as the potential loss is capped by the width of the spreads minus the net premium received.

- Reward: Limited, as the potential profit is limited to the net premium received.

Conclusion:

Options strategies provide investors and traders with diverse ways to capitalize on market movements, hedge against risk, and generate income. Each strategy has its own unique risk-reward profile, and the choice of strategy depends on the individual’s market outlook and risk tolerance.

Before implementing any options strategy, it is crucial to understand the associated risks, especially if leveraging positions or employing complex strategies. Moreover, options trading involves substantial risks and may not be suitable for all investors. Seeking advice from a financial advisor and gaining experience through paper trading or virtual accounts can help investors build the necessary knowledge and expertise before engaging in real options trading activities.