Option Pricing

Option pricing is a crucial aspect of options trading, as it determines the fair value of an option contract. The most widely used model for option pricing is the Black-Scholes model, which was developed by economists Fischer Black and Myron Scholes in the early 1970s. The model takes into account several factors that influence an option’s price:

- Underlying Asset Price: The current market price of the underlying asset plays a significant role in option pricing. For call options, as the underlying asset price rises, the option becomes more valuable (assuming all other factors remain constant). Conversely, for put options, a higher underlying asset price decreases the option’s value.

- Strike Price: The predetermined price at which the underlying asset can be bought or sold through the option contract. The difference between the underlying asset price and the strike price affects the option’s intrinsic value.

- Time to Expiration: The longer the time remaining until the option contract expires, the higher the option’s premium, as there is more time for the underlying asset to move in the anticipated direction.

- Volatility: Volatility measures the degree of price fluctuations in the underlying asset. Higher volatility increases the option’s premium, as there is a greater likelihood of significant price movements.

- Interest Rates: Interest rates impact option pricing through their effect on the present value of future cash flows.

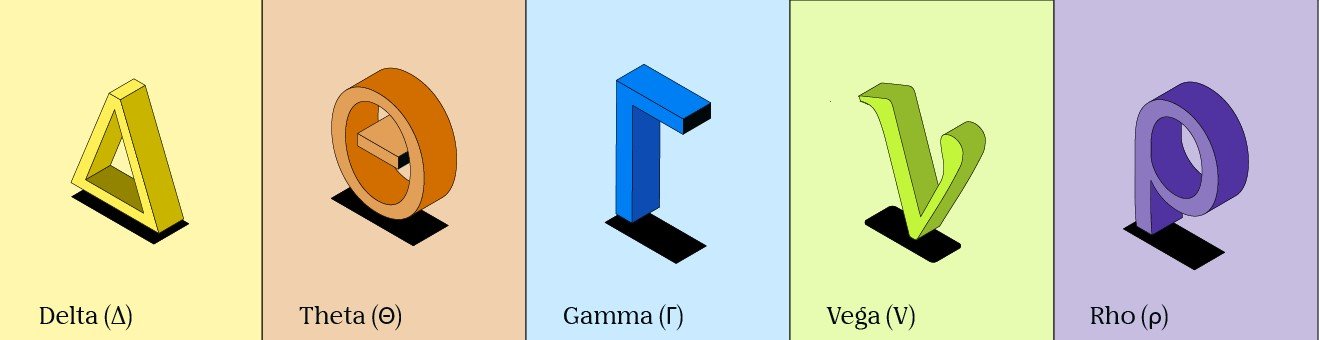

The Greeks

The Greeks are a set of mathematical variables used to quantify how an option’s price is affected by changes in various factors. Understanding the Greeks is vital for managing risk and optimizing options trading strategies. Let’s explore the main Greek parameters:

- Delta (Δ): Delta measures the sensitivity of an option’s price to changes in the underlying asset price. For call options, delta values range from 0 to 1, indicating the percentage change in the option’s price relative to a $1 change in the underlying asset price. For put options, delta values range from 0 to -1.

- Gamma (Γ): Gamma measures the rate of change of an option’s delta concerning changes in the underlying asset price. It indicates how much the delta will change for a $1 change in the underlying asset.

- Theta (Θ): Theta quantifies the impact of time decay on an option’s price. As an option approaches its expiration date, its value decreases due to diminishing time for the underlying asset to move favorably. Theta measures how much an option’s price will decrease with the passage of one day.

- Vega (ν): Vega gauges the sensitivity of an option’s price to changes in market volatility. It represents the change in the option’s price for a 1% increase in implied volatility.

- Rho (ρ): Rho assesses the effect of changes in interest rates on an option’s price. It indicates the change in an option’s price for a 1% change in interest rates.

Implications for Options Traders

Understanding option pricing and the Greeks empowers traders to make informed decisions. For example:

- Hedging Strategies: Traders can use delta to hedge their portfolios against price movements in the underlying asset.

- Time Sensitivity: Theta helps traders evaluate the impact of holding options for more extended periods, prompting timely decisions.

- Managing Volatility: Vega aids in assessing the risk associated with market volatility, crucial for positioning during periods of uncertainty.

Conclusion

Mastering option pricing and the Greeks unlocks the potential of options trading, offering a comprehensive understanding of how various factors influence an option’s price. Armed with this knowledge, traders can develop sound strategies, manage risk effectively, and capitalize on market opportunities. However, it’s essential to continuously educate yourself, stay updated on market trends, and practice trading with a cautious approach to succeed in the ever-evolving world of options trading.