Arbitrage is a trading strategy that involves exploiting price discrepancies for the same asset across different markets or trading venues to lock in risk-free profits. High-Frequency Trading (HFT) firms have leveraged their speed and technological capabilities to execute arbitrage strategies with lightning-fast precision. In this explanation, we will explore the main types of HFT arbitrage strategies and how they aim to capitalize on market inefficiencies.

1. Market-Making Arbitrage

Market-making arbitrage is a prevalent HFT strategy that involves acting as a liquidity provider by simultaneously placing both buy and sell orders for the same asset. HFT firms place tight bid-ask spreads, profiting from the difference between the prices at which they buy and sell the asset. Market-making HFT algorithms constantly adjust their bid-ask spreads based on real-time market conditions to remain competitive and ensure a steady stream of trading opportunities.

2. Statistical Arbitrage

Statistical arbitrage, also known as stat arb, relies on statistical modeling and quantitative analysis to identify mispricings in related assets or instruments. The strategy involves pairing assets that are expected to move in tandem based on historical correlations. When the relationship between the two assets deviates from its historical pattern, the HFT algorithms execute trades to take advantage of the divergence, anticipating that the relationship will eventually revert to its mean.

3. Triangular Arbitrage

Triangular arbitrage is an HFT strategy applied in the foreign exchange (forex) market. It involves exploiting price discrepancies in currency pairs with a common currency. For instance, if the exchange rate between USD/EUR and EUR/GBP is not consistent with the USD/GBP rate, a triangular arbitrage opportunity arises. HFT algorithms can execute a series of rapid trades between these currency pairs to capitalize on the inefficiency and generate profits.

4. Convergence Trading

Convergence trading, also known as pairs trading, is a popular HFT strategy that involves identifying two assets with a historically strong correlation. When the correlation weakens temporarily, HFT algorithms take opposite positions in the two assets, expecting the correlation to revert to its normal pattern. Once the correlation strengthens again, the HFT firm exits the positions, realizing a profit from the convergence of the two asset prices.

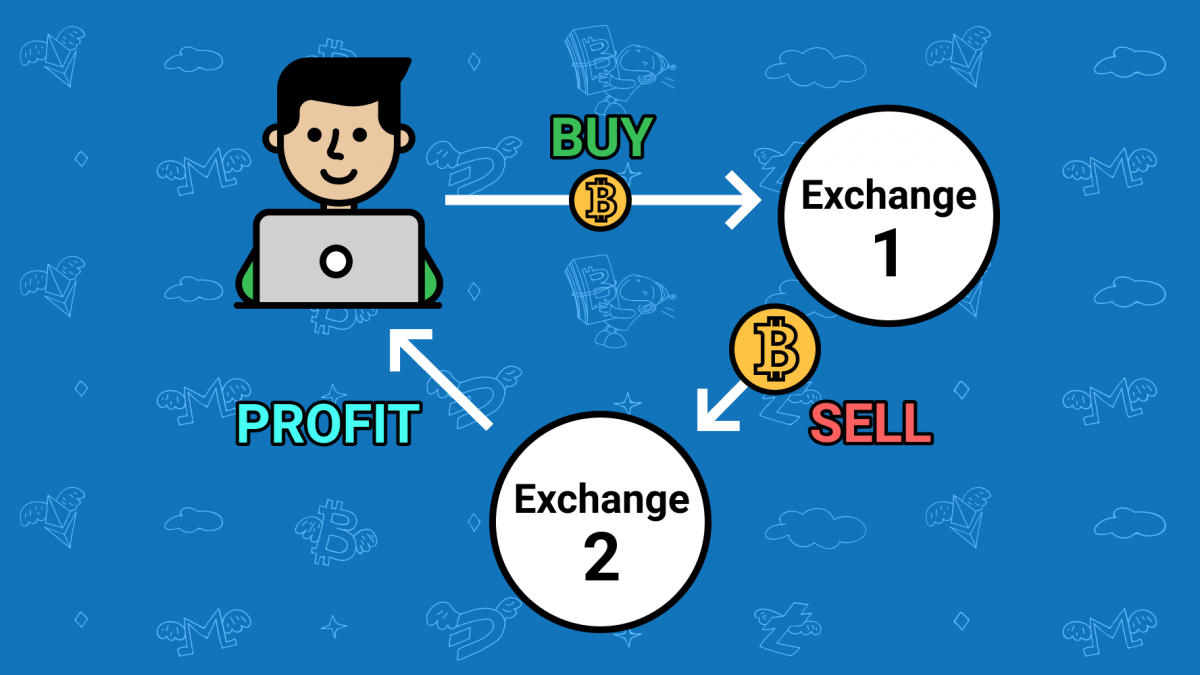

5. Cross-Exchange Arbitrage

Cross-exchange arbitrage involves capitalizing on price discrepancies for the same asset across different cryptocurrency exchanges. Due to the decentralized nature of cryptocurrency markets and varying levels of liquidity on different exchanges, HFT firms can execute rapid trades to profit from momentary price differences between exchanges.

Conclusion

HFT arbitrage strategies exemplify the cutting-edge capabilities of modern financial markets. By leveraging advanced algorithms, high-speed technology, and real-time market data, HFT firms identify and exploit fleeting market inefficiencies, generating profits with unparalleled speed and efficiency. These arbitrage strategies contribute to market liquidity, narrow bid-ask spreads, and enhance overall market efficiency.

However, it is essential to recognize that HFT arbitrage is a highly competitive space, and success requires continuous technological innovation, robust risk management, and strict adherence to regulatory guidelines. While HFT arbitrage strategies contribute to market liquidity and efficiency, they have also sparked debates on market fairness and potential market manipulation concerns. As the financial landscape continues to evolve, market participants and regulators must strike a balance between promoting innovation and ensuring market integrity in the realm of HFT arbitrage.